By Professor Dennis R. Shaughnessy

A new book called “Bad Blood: Secrets and Lies in a Silicon Valley Startup” by John Carreyrou is an amazing chronicle of the failed life sciences company Theranos and its founder, Elizabeth Holmes. This is one of the best business books of the recent past, on par with “Barbarians at the Gate” for a thrilling ride through the dark side of business.

Elizabeth Holmes was once a self-made billionaire, having founded Theranos as a disruptive blood testing company after dropping out of Stanford. She idolized Steve Jobs, to the point of dressing and speaking like him. She also shared Jobs’ power to create “reality distortion fields” that captured the imagination of many, especially the media. Holmes managed to convince some of the most accomplished members of the technology and investment community that an idea was actually a business, when in fact it was an unproven technology with questionable scientific validity.

Fortune Cover of Elizabeth Holmes by Joe Pugliese

Along her entrepreneurial journey, Holmes was backed by the “who’s who” of the business, venture capital and political communities, many of whom joined her Board. Theranos rose to become one of Silicon Valley’s so-called “unicorns”, with a pre-IPO valuation of nearly $5 billion. The biggest names in Silicon Valley praised Holmes as a game changing “disruptor” for the healthcare industry.

The problem was that Theranos wasn’t a real company. The technology in all of its iterations didn’t work. And so Holmes relied on charisma to avoid disclosing the truth. In the end, thousands of employees lost their jobs, and investors lost all of their money (including more than $100 million from Secretary of Education Betsy Devos and Rupert Murdoch of Fox). Most important of all, Theranos failed patients who relied on flawed tests to make treatment decisions.

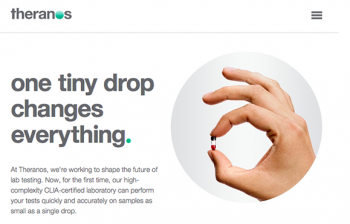

The book provides a remarkable insider’s view of how one of the great frauds of modern business could have happened in plain view. Holmes was full of intelligence, sophistication, charm and charisma, and she used it to promote a promising but ultimately failed technology (broad blood testing with a single drop). Regulatory officials missed it, investors didn’t do their due diligence, board members ignored the warning signs, and employees failed to speak truth as a result of a culture of secrecy and intimidation.

The SEC successfully brought civil charges against Holmes and others, and now criminal charges are being pursued by the Justice Department. The once high-flying company is winding down and destined for bankruptcy and insolvency.

As is often the case, greed is at the core of the Theranos fraud. Intense greed among a few leaders, and greed in its many derivative forms among so many others in Holmes’ orbit. So many on the outside desperately wanted to see Holmes and Theranos succeed as the first major woman-led Silicon Valley success story in the health tech space. We now see that wanting success is not the same thing as earning it.

Fear of missing out (FOMO) also plays a large part in the failures of the investing community. A desire to be part of a network of prominent elite figures in society appears to play a part in the decision of people like current Secretary of Defense Mattis and former Secretaries of State Shultz and Kissinger, to jump on board.

“Bad Blood” suggests that a set of core values and a strong sense of social purpose are the keys to building a successful and sustainable business. Values like honesty, integrity, accountability, transparency and inclusion. A meaningful purpose beyond wealth creation and self-enrichment. These are things prized by inspired leaders of social enterprises and social impact businesses around the world. All appeared to be missing at Theranos, and lacking in Ms. Holmes.

The story of Theranos and Holmes as captured by John Carreyrou is a compelling story of greed and hyper-capitalism, Silicon Valley style. If you don’t read the book, then “Bad Blood” the movie starring Jennifer Lawrence as Elizabeth Holmes is coming to a theatre near you!